how much child benefit and child tax credit will i get

In order to receive the full benefit amount of 3600 you will need to meet the income threshold of 75000 or under for single filers and claim dependents from 5 years of. The taxpayers earned income and their adjusted gross income AGI.

When Families Do Well America Succeeds Make Expanded Child Tax Credit A Permanent Benefit The Seattle Times

Already claiming Child Tax Credit.

/cdn.vox-cdn.com/uploads/chorus_asset/file/8399887/ChildAllowance_report.png)

. 3600 for each child under age 6 and 3000 for each child ages 6 to 17. Eligibility caps at 100000 income for a single. Increased the credit from up to 2000 per qualifying child in 2020 to up to 3000 for each qualifying child ages 6 to 16.

415 44 votes. To qualify for the maximum amount of 2000 in 2018 a single. The amount you can get depends on how many children youve got and whether youre.

6 min read. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. If families join together If 2 families join together the eldest child in the new family qualifies.

3600 for each child under age 6 and 3000 for each child ages 6 to 17To get money to families sooner the IRS is. For the period of July 2022 to June 2023 you could get up to 2985 24875 per. Millions of families across the US will be receiving their third.

Most families will receive the full amount. If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for. Qualified families will receive a payment of up to 300 per month for each child under 6 and up to 250 per month for children between the ages of 6 and 17.

150000 for a person who. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. To get money to families sooner the IRS is sending.

Receives 3600 in 6 monthly installments of 600. Makes 17-year-olds eligible for up to 3000 in credit. Total Child Tax Credit.

From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six. Most families will receive the full amount. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

If you have other children who are entitled to Child Benefit youll get 1445 for each child. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Two Factors limit the Child Tax Credit.

The two most significant changes impact the credit amount and. Making a new claim for Child Tax Credit. Big changes were made to the child tax credit for the 2021 tax year.

Families could receive child tax credit rebates for up to 250 per child under age 18 maxing out at three kids. Our calculator will give you the answer. Increased to 7200 from 4000 thanks to the American Rescue Plan 3600 for each child under age 6.

150000 if you are.

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

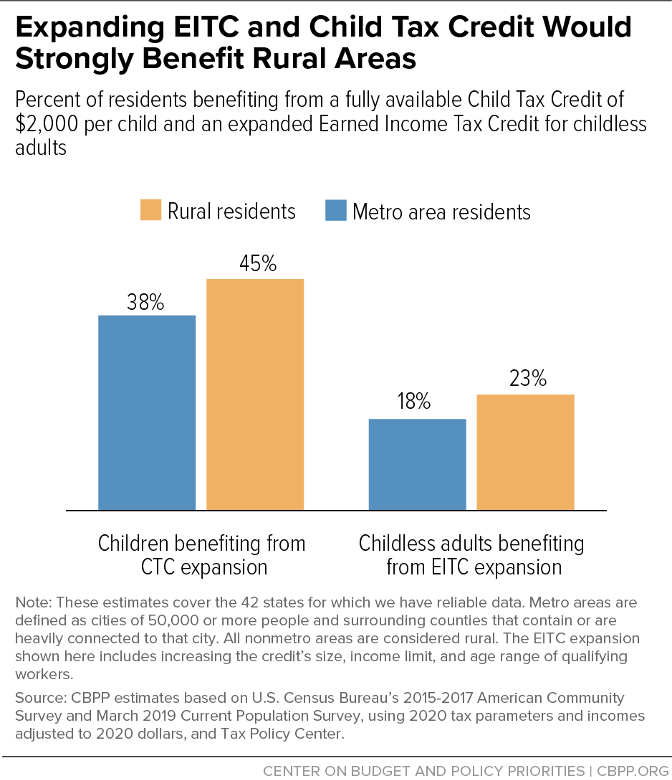

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit U S Senator Michael Bennet

The Tax Benefits Of Having An Additional Child Tax Foundation

How Can Children Benefit From The Us Child Tax Credit In The Future Humanium

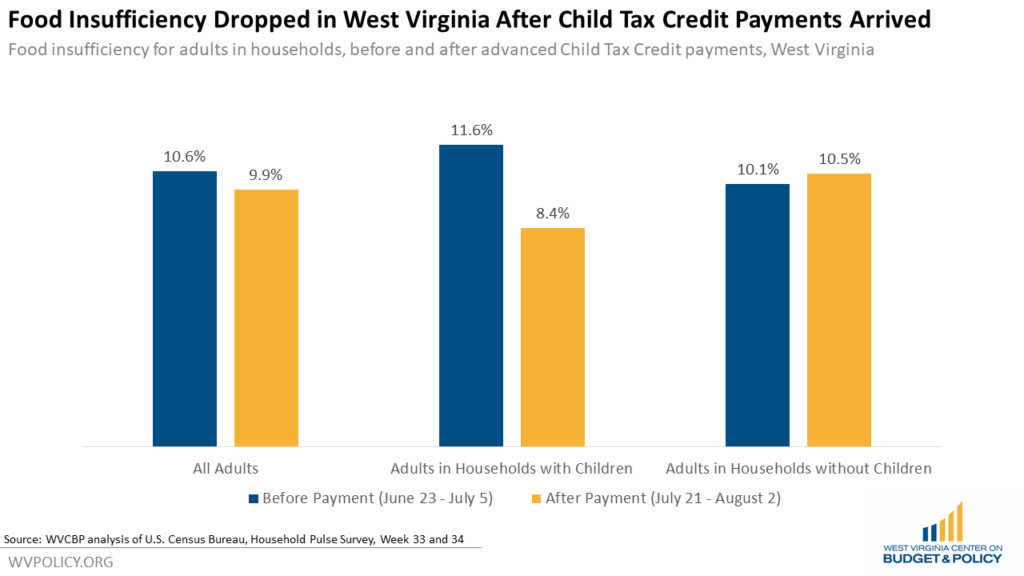

Data Already Showing Positive Impacts Of Child Tax Credit Though More Can Be Done To Ensure Benefit Reaches All Children West Virginia Center On Budget Policy

Child Benefit Cuts What Are The Government S Options Politics Theguardian Com

Child Tax Credit Monthly Checks What To Know With 1 Month To Go King5 Com

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

/cdn.vox-cdn.com/uploads/chorus_asset/file/8399887/ChildAllowance_report.png)

Child Poverty In The Us Is A Disgrace Experts Are Embracing This Simple Plan To Cut It Vox

Kentucky Indiana Families To Benefit From Child Tax Credit Whas11 Com

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Tax Break Down Child Tax Credit Committee For A Responsible Federal Budget

What Families Need To Know About The Ctc In 2022 Clasp

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Tool Opens For Poorer Families To Claim Tax Benefits Without Filing A Full Return

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Child Tax Credit Is A Permanent Child Benefit The Solution Marca